Is Mold Covered By Home Insurance

Home insurance policies usually dont cover mold that resulted from a preventable water leak flooding or high humidity. Generally policies offer no coverage for mold due to maintenance issues.

Does Homeowners Insurance Cover Mold Insurance Com

Does Homeowners Insurance Cover Mold Insurance Com

The biggest fight is proving to the insurance company that the cause of the mold actually came from the water damage and not.

Is mold covered by home insurance. Your insurance company may let you add coverage for cleanup caused by a covered loss. A plumbing leak that causes a mold problem is an extremely easy issue to get covered by an insurance claim. Homeowners insurance policies often include vague wording regarding mold coverage and it can be difficult to determine whether any mold damage you encounter will be covered.

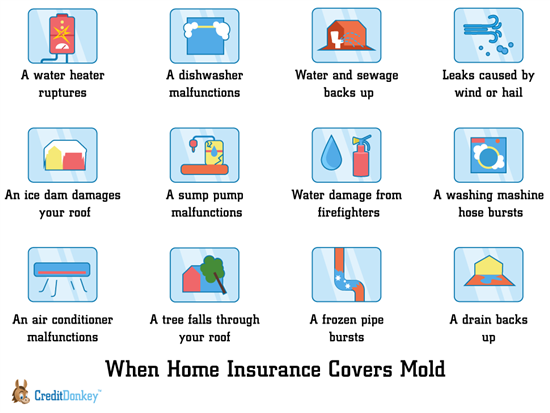

The standard homeowners insurance protects against water damage resulting from accidental and sudden incidences. If a roof leak happens it is likely to not be covered unless it is a leak caused by a natural disaster like a hurricane then it has a very high. Usually mold mildew fungus or spores will be covered by home insurance if they were the result of a specific problem that was covered by your policy.

Yet that doesnt mean a mold claim will be denied automatically. If mold damage is included in the policy its because the mold came from a peril thats covered by the insurance. Mold is a costly issue for homeowners and its one that is only covered by home insurance in specific instances.

Home Insurance Will Only Cover Mold If It Was Caused by a Covered Peril Mold damage is quite often a result of preceding water damage. However you may be able to get reimbursed for its removal if it was caused by something that your insurance policy does cover. Mold and Home Owners Insurance Most basic home owners insurance policies exclude coverage of damage caused by mold fungi and bacteria says Mark Ferguson property claim specialist with General Casualty Insurance in Sun Prairie Wis.

Mold coverage isnt guaranteed by your homeowners insurance policy. Mold damage caused by. Typically mold damage is only covered if its related to a covered peril.

Most home policies dont include mold cleanup and testing after a damaged item is removed. With regard to mold damage the cause of the damage determines whether your insurance provider will. For example you have a burst pipe which is covered and mold results from the incident.

When mold is covered by your insurance You may be covered for sudden mold-related incidents specified on your policy. Mold coverage is coverd into your home insurance policy if it was caused by a covered peril. Another scenario where you could be covered is if your water heater bursts and floods your basement causing mold in the aftermath.

We will get to it later in this article. AC units breaking and causing a high humidity issue in a home is almost never covered. Otherwise an insurance company will likely not cover mold damage.

Your agent can tell you what options are available. Some home insurance policies cover mold caused by covered events. However home insurance policies will cover mold damage if it was caused by what is called a covered peril.

When Is Mold Covered by Your Insurance. For example dont expect insurance to help if you had a pipe that. An example would be water damage from a burst.

Your condo homeowners or renters insurance policy will only cover mold removal if the mold was caused by already covered perils like water damage. Homeowners insurance covers mold damage if a covered peril caused it. Mold is covered by your homeowners insurance if it is the result of water damage related to what the insurance industry terms a common peril Such perils include burst pipes and.

If you have a water leak or flooding. Mold isnt directly covered by homeowners insurance. Typically mold damage is covered by your insurance when it develops a problem from water damage which is covered under your policy.

While homeowners insurance offers a lot of coverage it doesnt cover everything. There are exceptions though. Add mold insurance to your policy and save money on your mold removal cost.

The other challenge with making a mold insurance claim is understanding your coverage. Usually these policies do not cover mold damage except for when the mold is a direct result of a claim they do cover such as flooding or water damage. For example a fire in your home is put out with hose-water which then caused dampness and mold.

Typically policies exclude coverage for mold damage except when the mold is the result of a covered claim such as water damage. Some insurers offer endorsements for mold damage but these add-on coverages can be costly. Homeowners insurance policies typically keep their wording very vague in regards to mold coverage.

By default a homeowners insurance policy will not cover mold damage.

Does Homeowners Insurance Cover Mold Hippo

Does Homeowners Insurance Cover Mold Hippo

Does Homeowners Insurance Cover Mold Bankrate

Does Homeowners Insurance Cover Mold Bankrate

Does Home Insurance Cover Mold Or Other Nuisances Your Aaa Network

Does Home Insurance Cover Mold Or Other Nuisances Your Aaa Network

Is Mold Damage Covered By Homeowners Insurance Claimsmate

Is Mold Damage Covered By Homeowners Insurance Claimsmate

Mold Remediation Cost Eliminating Mold In Household

Mold Remediation Cost Eliminating Mold In Household

Can Mold Infestations Be Covered By Home Insurance

Can Mold Infestations Be Covered By Home Insurance

Is Mold Covered By Homeowners Insurance

Is Mold Covered By Homeowners Insurance

What Does Home Insurance Cover When It Comes To Mold

What Does Home Insurance Cover When It Comes To Mold

When Does Home Insurance Cover Mold Valuepenguin

Is Mold Damage Covered By Homeowner S Insurance

Is Mold Damage Covered By Homeowner S Insurance

Mold Insurance For Your Home What To Know Trusted Choice

Mold Insurance For Your Home What To Know Trusted Choice

Does Homeowners Insurance Cover Mold Forbes Advisor

Does Homeowners Insurance Cover Mold Forbes Advisor

Home Insurance Mold Does Homeowner Insurance Cover Mold

Home Insurance Mold Does Homeowner Insurance Cover Mold

Does Homeowners Insurance Cover Mold

Does Homeowners Insurance Cover Mold

Comments

Post a Comment