Capital Gains Tax Crypto

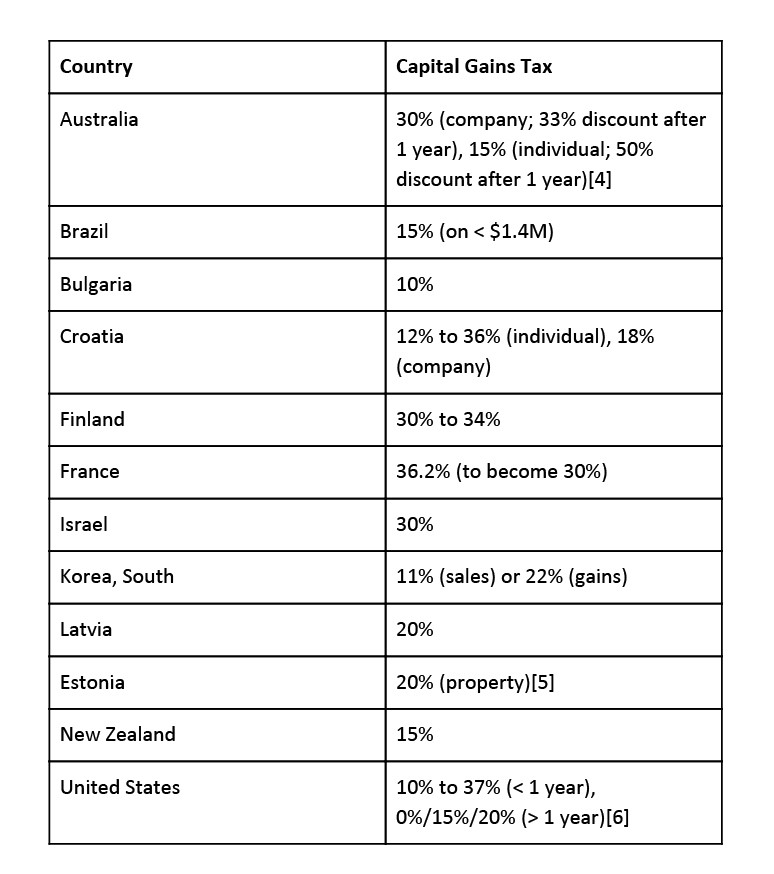

The federal tax rate on cryptocurrency capital gains ranges from 0 to 37. The idea of an 80 crypto capital gains tax has some investors in digital assets worried.

The Ultimate Crypto Tax Guide 2021 Cryptotrader Tax

The Ultimate Crypto Tax Guide 2021 Cryptotrader Tax

Long-term capital gains tax is applied to profits made from the sale of an asset held for over a year.

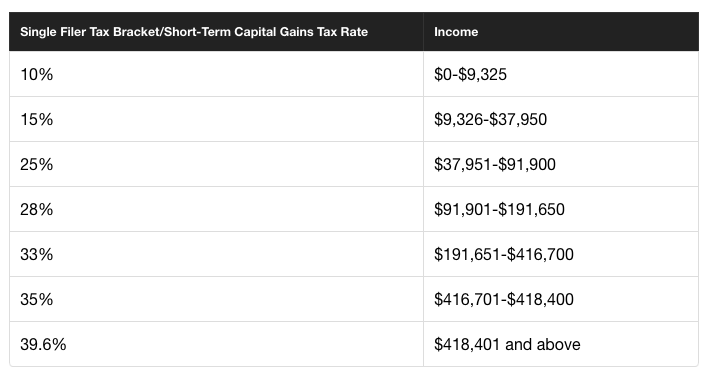

Capital gains tax crypto. Thats been clear by the selloff that many cryptos including Bitcoin CCCBTC-USD have seen lately. Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency. Less than one year.

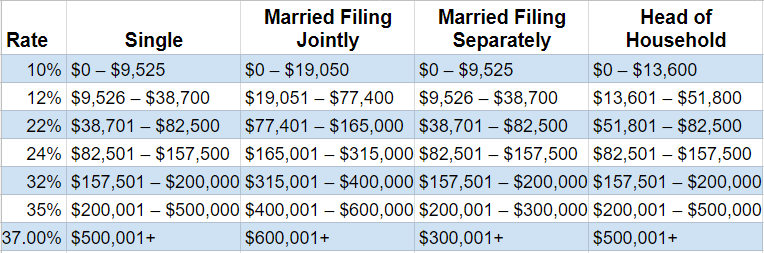

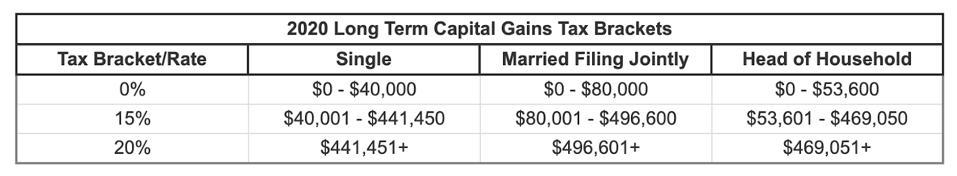

Your specific tax rate primarily depends on three factors. It is currently applied in rates of zero percent 15 percent or 20 percent depending on the. If you invested 50000 into cryptocurrency and made 1000000 on your investment firstly congratulations.

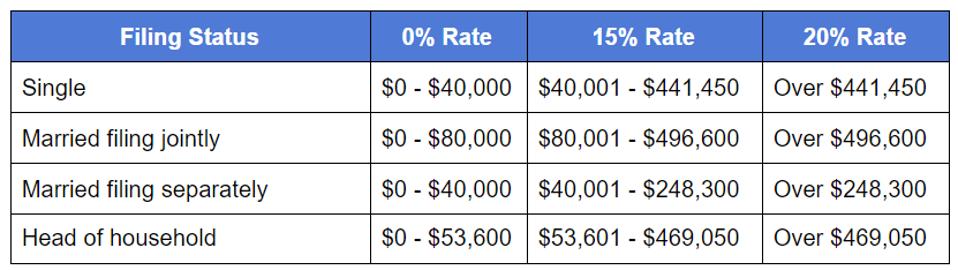

When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. Reports suggest that the Biden administration could double the capital gains tax from 20 to 396 for large investors. When your crypto gains are taxed your cryptocurrency tax rate will be either your income tax rate or lower capital gains rates depending on how long you held the crypto.

Your holding period dictates whether you pay income tax rates or capital gains tax rates. You pay Capital Gains. However if your taxable income puts you into the highest tax bracket of 37 your long-term capital gains tax rate increases to 20.

Crypto investors already face a capital-gains tax if they sell the cryptocurrency after holding it for more than a year. We go into all the different types of capital gains events in more detail below. Bitcoin has been one of the best-performing assets in recent years and has.

Applying a method to get a certain tax treatment for crypto transactions eg. Bitcoin Sinks as US Capital Gains Tax Proposal Injects Fear Into Crypto Market 2021-04-23 023000 Thomas Westwater Analyst Bitcoin BTCUSD Capital Gains Tax Talking Points. What are my cryptocurrency tax rates.

When Am I Subject To The 20 Crypto Capital Gains Tax Rate. Youre correct that cryptocurrency is not a form of moneycurrency for tax purposes. Capital Gains Tax CGT Capital Gains Tax CGT The ATO classifies digital currency as an asset much like a share in a company or a house which means that you need to assess your capital gains every time you sell trade or give away your crypto.

Changes to the annual exempt amount for Capital Gains Tax for the tax. The overall crypto market lost more than 200 billion in Fridays trading session after reports surfaced that President Joe Biden would seek to raise capital gains taxes on millionaire investors. Check if you need to pay tax when you receive cryptoassets.

1 The accounting method used for calculating gains. Losses may be used to offset capital gains in a given tax year plus 3000 this means that any losses incurred on bitcoin and other crypto may be deductible unlike losses on your car. Other capital assets include things like stocks and bonds.

Under existing legislation cryptocurrency is considered to be a capital asset and capital gains tax rules apply on the disposal of these assets. Almost everyone else enjoys the 15 long-term capital gains tax rate. 5 rows Short-Term vs Long-Term Crypto Capital Gains.

Though the tax will not affect most crypto investors it could be detrimental to the crypto industry in a broader sense. Capital Gains and Losses for Crypto Your capital gains and losses from your crypto trades get reported on IRS Form 8949. The news caused stock markets and crypto markets to lose value.

Uk Cryptocurrency Tax Guide Cointracker

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Capital Gains Tax On Bitcoin Hash Formula The Town Media

Capital Gains Tax On Bitcoin Hash Formula The Town Media

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

Tutorial Crypto Taxes For Beginners

Tutorial Crypto Taxes For Beginners

From 0 To 55 A Brief Guide To Cryptocurrency Taxation Around The World Hacker Noon

From 0 To 55 A Brief Guide To Cryptocurrency Taxation Around The World Hacker Noon

What S Your Tax Rate For Crypto Capital Gains

What S Your Tax Rate For Crypto Capital Gains

Crypto Taxes How To Calculate Capital Gains By Focus Accounting Cpa Firm Medium

Crypto Taxes How To Calculate Capital Gains By Focus Accounting Cpa Firm Medium

What S Your Tax Rate For Crypto Capital Gains

What S Your Tax Rate For Crypto Capital Gains

Biden S Proposed Capital Gains Tax Rise Will Hit Only Richest 0 3

Biden S Proposed Capital Gains Tax Rise Will Hit Only Richest 0 3

Crypto Tax 2021 A Complete Us Guide Coindesk

Crypto Tax 2021 A Complete Us Guide Coindesk

Comments

Post a Comment